The third factor is associated with the adoption of new technologies by consumers, especially the new generation of digital natives ( Basel Committee on Banking Supervision, 2018). The second factor was the decrease in consumer, business and government confidence in the large banking institutions after the 2008 financial crisis ( Arner et al., 2015 Larsson, Teigland, Shahryar, Moreno, & Bogusz, 2018) and the need to reduce the concentration of transactions in large banks thereafter. This technological progress has generated changes in financial products, services, production processes and organizational structures ( Frame, Wall, & White, 2018). These innovations have enabled the processing of higher volumes of information, increased storage capacity and automation of decisions in the financial sector ( He et al., 2017), traditionally characterized as the vanguard in the application of “information technology” (IT) innovations ( Arner, Barberis, & Buckley, 2015 Barras, 1990). The first was the emergence of new technologies such as big data, distributed ledger technology, cloud computing, artificial intelligence and machine learning ( Basel Committee on Banking Supervision, 2018 Gomber, Koch, & Siering, 2017 International Monetary Fund, 2019 Jagtiani & John, 2018). Three factors contributed to the emergence and growth of FinTechs.

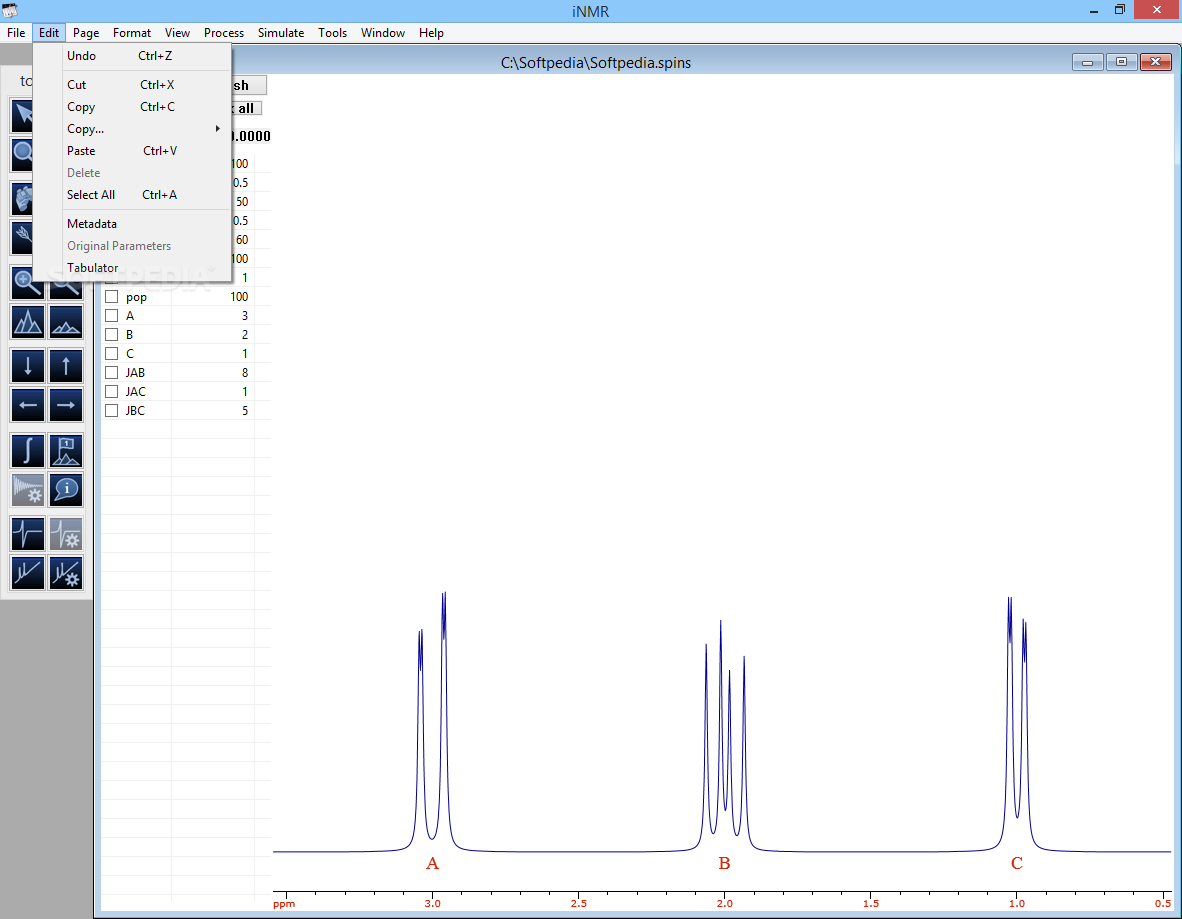

#Inmr inmr reader differences software#

The different software and applications developed require study, not only for the use of new technologies to offer traditional services, but also for the competition and complementarity of these with the agents of the traditional financial system.

#Inmr inmr reader differences full#

The full terms of this licence may be seen at įinTechs are an example of technological innovations competing with the traditional system of service provision, in this case, the provision of financial services. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Published in Innovation and Management Review. Copyright © 2020, Itamir Caciatori Junior and Ana Paula Mussi Szabo Cherobim.

0 kommentar(er)

0 kommentar(er)